It is important for taxpayers to know why changes appear on their property tax statements, especially when there was no referendum on the ballot.

What was approved and why there was no public vote: The recent increase is tied to the school board’s approval of a Long-Term Facilities Maintenance (LTFM) / Indoor Air Quality (IAQ) levy and abatement bonds, which state law allows districts to use without a public vote when addressing required health, safety, and structural needs. This includes HVAC and ventilation updates, meeting indoor air quality standards, and improving parking lot safety and accessibility.

The state requires districts to meet ventilation, structural, and safety codes but does not fully fund the infrastructure necessary to do so. The LTFM/IAQ levy is the tool the state provides to school boards to address these requirements responsibly.

The goal is to protect the buildings the community has already invested in and ensure they remain safe, functional, and compliant for students, staff, and residents who use them.

The need: The scope of this work is critical to the running of the facilities and spans all district buildings except the district office and addresses aging heating, cooling, and ventilation. The work includes approximately 80 different facility improvement measures, ranging from direct replacement of air handling units and roof top units, through to electrical distribution replacements, and the addition of cooling in spaces such as the middle school gyms.

Additionally, a significant factor that was considered is that most of the air-handling units date back to the 1960s and 1970s and no longer meet current code or ventilation standards. Replacing or upgrading them is necessary to ensure safe and healthy learning environments for students and staff.

A presentation was given to the board on June 23 concerning the overall infrastructure of the district, which can be found by watching the board meeting. The presentation starts at the 19 minute mark.

School Board decision making: The school board works hard to be responsible stewards of taxpayer-funded facilities, especially as many of the buildings in the district are aging and require updates to remain safe, functional, and compliant. Delaying maintenance only increases future costs and shifts a greater burden onto taxpayers later. The LTFM and IAQ tools provided by the state are specifically designed so districts can address these long-term, unavoidable needs in the most cost-effective way possible.

Tax breakdown: The full tax breakdown was included in the August 25th School Board Meeting packet on the district website. This topic was discussed at multiple meetings, and there was also a public hearing. This was all open to the public and notices were posted.

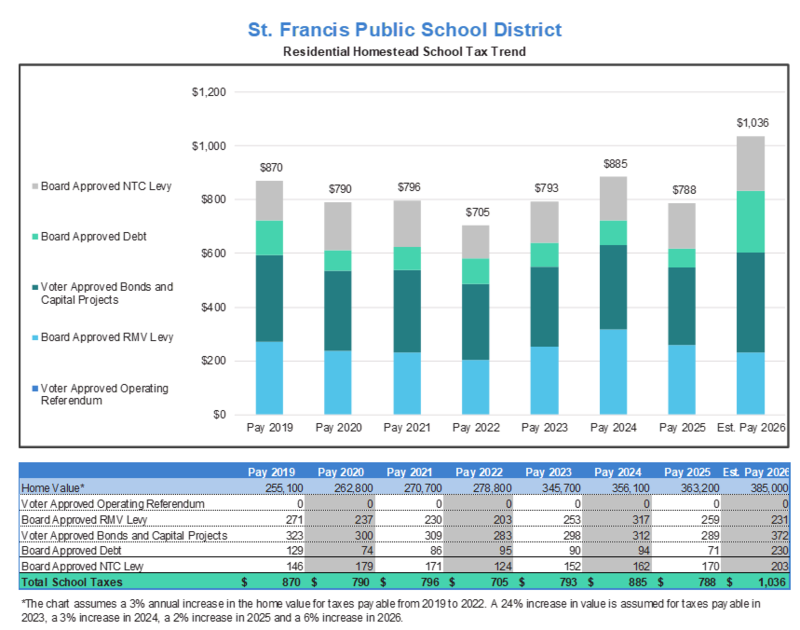

An example from that presentation:

A residential homestead valued at $385,000 sees an estimated annual increase of:

$214 for the LTFM bonds

$19 for the abatement bonds

Total: $234 per year (approximately $19.50 per month)

This increase brings the district back to a level that voters originally supported in past years. With fiscally responsible bond structuring, the district and the school board have saved taxpayers on previous voter-approved referendums and have made the decision to use board authority to address these much-needed projects.

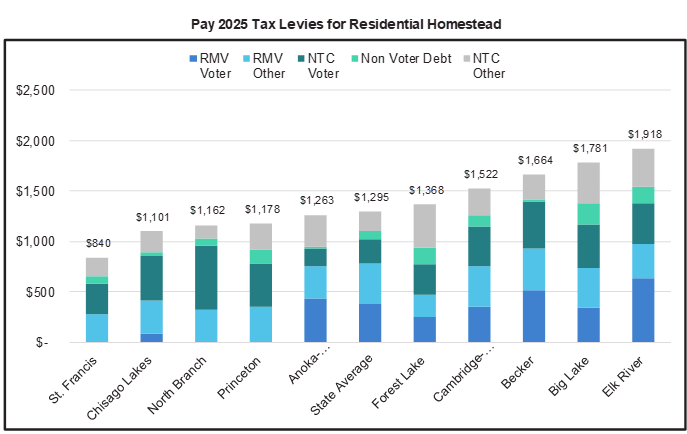

Here is a comparable tax table for 2025 - and the historical rates of taxes for St Francis as well as the projected 2026. Current tax rates, even at its new number, are consistent against property value. In the lowest year, 2022, the tax rate was approximately 0.0025 of property value ($705/$278,800). In 2026, this ratio is now 0.0027 of property value. ($1036/$385,000).

The district's municipal advisor (financial advisor) completed a presentation on the overall funding of the district, and the impact of taxes, for a community engagement group.